Objection and appeal VAT returns

Do you disagree with the tax authorities and can’t resolve it with the tax inspector? You probably first try to assert your rights through an objection procedure. If this does not result in the desired ruling from the tax authorities, you can appeal or take the case to the Supreme Court. At LENOS c.s., we can handle the objection and appeal procedure for VAT returns. Naturally, our VAT specialists can assess the feasibility of the case in advance. We closely follow both national and international VAT developments, which allows us to assist you both domestically and abroad.

In-depth expertise

Knowledge of objections and appeals for VAT returns is crucial. We sometimes see from a distance that certain appeal procedures are immediately nipped in the bud due to formal errors. The person submitting the appeal sometimes has a strong case, but is, for example, unfamiliar with the exact formalities of the process. He overlooks certain things and still loses. Our VAT specialists can prevent this by conducting the objection and appeal procedure for your VAT return.

What is the added value of our VAT specialists?

- In-depth knowledge of objections and appeals;

- Combined view of the formal and material side of things;

- Up-to-date with national and international VAT developments;

- Expertise in complex matters at home and abroad.

Combination of the formal and material side of things

Are you considering objecting or appealing against a VAT return? With our many years of experience and a combined view of the formal and material side of matters, we stand up for your rights and interests as much as possible. We follow the laws and regulations and supplement these principles with up-to-date knowledge of the latest developments and recent (legal) rulings, which significantly increases your chances. Would you like to know whether you have a chance of filing an objection and appeal with your VAT return? Contact us and we will assess the case, the arguments, the feasibility and your chances.

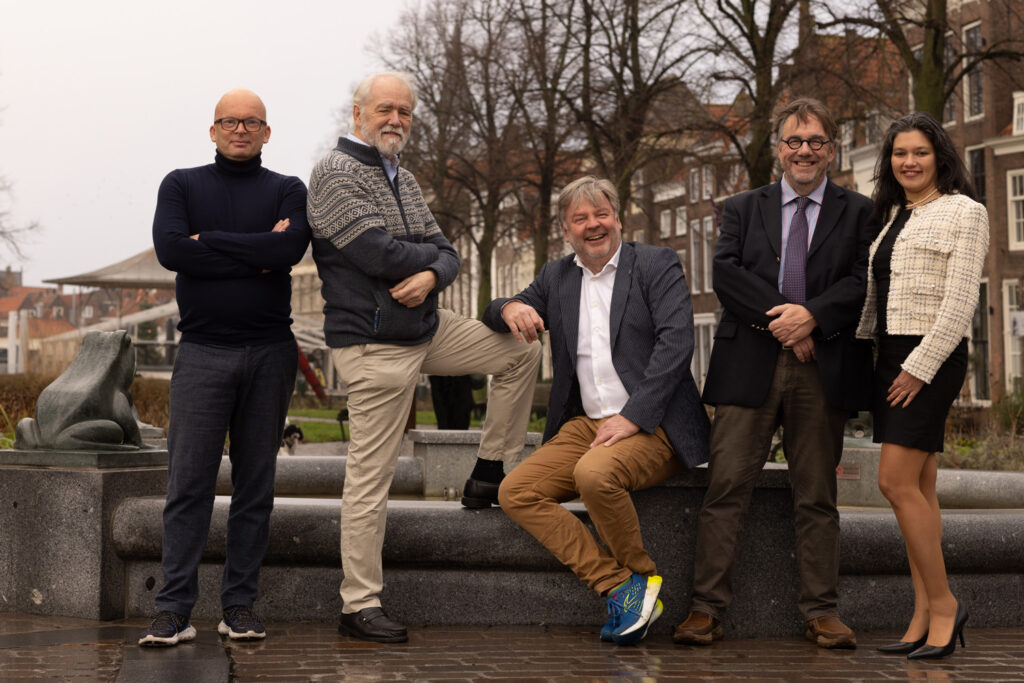

Contact our professionals

Our partners are tax lawyers. We offer all the benefits of a smaller, flexible firm coupled with the experience one usually only finds in the largest tax consultancy firms. All partners have a long experience as VAT and customs inspectors with the Dutch Ministry of Finance as well as VAT and customs consultants with the largest tax consultancy firms in The Netherlands.

Paul Lenos

Managing Partner / VAT Counsel head of compliance

Paul is Dutch spoken, fluent in English and German, and has a good notion of French. He is a graduate of the Erasmus University in Rotterdam. He holds a degree in civil law. Paul has been attorney-at-law from 2012 till 2021. At the moment Paul is managing partner and as VAT counsel head of compliance, mainly for the foreign client base.

Toon Hasselman

Partner

Although specializing in VAT – his ‘taxes’ degree – his knowledge and experience extends far beyond this, and his teams have included International Trade & Customs (and other) Indirect Taxes specialists too. Toon has a no-nonsense approach, with a conclusive solution.

Michael van de Leur

Partner

Michael advises various national and international corporations, non-profit organizations and sometimes even government agencies on indirect taxation. His primary advises on VAT, his other areas of interest being real estate transfer taxes, import duty and excise duties.