VAT advisory services

At LENOS c.s. we leverage our extensive VAT expertise to offer comprehensive guidance on Dutch VAT regulations, ensuring full compliance management. Whether it’s standalone VAT reporting or part of an integrated administration, our services are tailored to meet your needs.

We offer a full range of VAT advisory services, including:

- Evaluating VAT implications for individual transactions;

- Managing IntraStat reporting requirements;

- Assisting with VAT registration processes;

- Facilitating VAT refund applications for non-resident entities in the Netherlands;

- Processing VAT refund applications across other EU countries;

- Preparing and submitting periodic VAT returns;

- Overseeing Intra-Community Sales Listings;

- Providing support for Article 23 license applications for import deferral;

- Maintaining regular communication with tax authorities on all VAT compliance issues.

VAT solutions for seamless compliance

Whether you need a complete VAT solution or ongoing advice and support, we are dedicated to ensuring your organization remains fully compliant. Our proactive approach means we continuously monitor your VAT processes, identifying potential risks before they become issues. With our deep understanding of both local and international VAT regulations, we can navigate even the most complex situations. Trust in our expertise to keep your business operating smoothly, with compliance as a priority every step of the way.

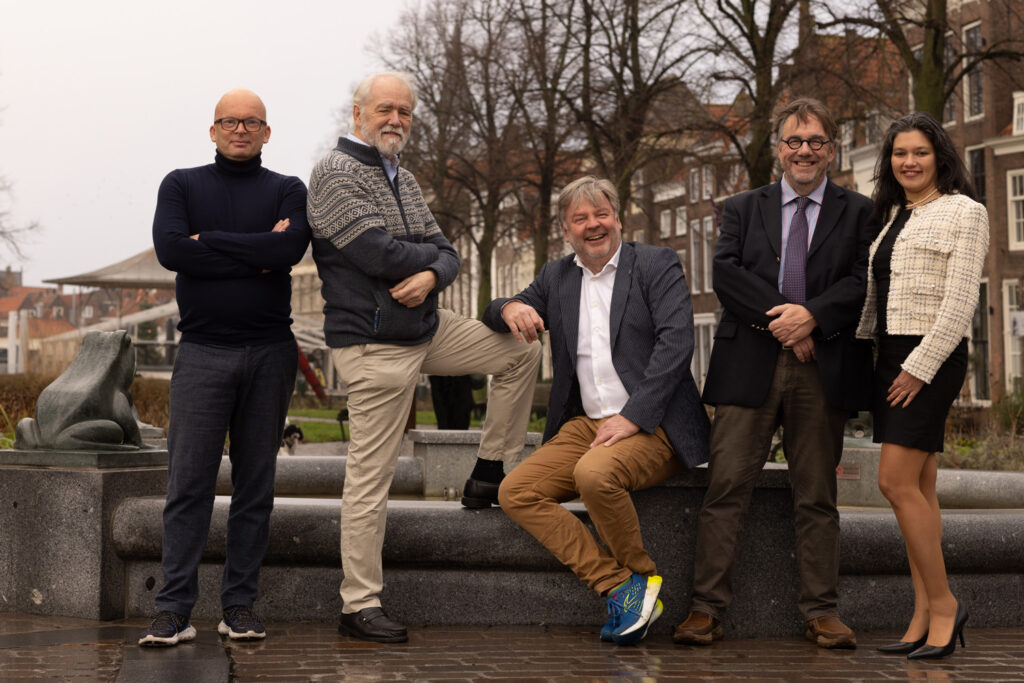

Contact our professionals

Our partners are tax lawyers. We offer all the benefits of a smaller, flexible firm coupled with the experience one usually only finds in the largest tax consultancy firms. All partners have a long experience as VAT and customs inspectors with the Dutch Ministry of Finance as well as VAT and customs consultants with the largest tax consultancy firms in The Netherlands.

Paul Lenos

Managing Partner / VAT Counsel head of compliance

Paul is Dutch spoken, fluent in English and German, and has a good notion of French. He is a graduate of the Erasmus University in Rotterdam. He holds a degree in civil law. Paul has been attorney-at-law from 2012 till 2021. At the moment Paul is managing partner and as VAT counsel head of compliance, mainly for the foreign client base.

Toon Hasselman

Partner

Although specializing in VAT – his ‘taxes’ degree – his knowledge and experience extends far beyond this, and his teams have included International Trade & Customs (and other) Indirect Taxes specialists too. Toon has a no-nonsense approach, with a conclusive solution.

Michael van de Leur

Partner

Michael advises various national and international corporations, non-profit organizations and sometimes even government agencies on indirect taxation. His primary advises on VAT, his other areas of interest being real estate transfer taxes, import duty and excise duties.